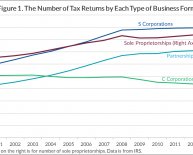

Business organization examples

Want to start a company? One of the primary steps is select its type. In this concept, might understand the main techniques companies are arranged with instances offered as you go along.

Why Is It Essential?

Company entities are not the same. Some provide proprietors some freedom in general management and control plus some don't. Some supply proprietors a significant level of defense against responsibility many cannot. Some are heavily managed, and some aren't. On top of these differences is the fact that our friendly tax rule provides various taxation remedies for different company entities. Most of these factors should be thought about whenever a business owner is selecting the type of company entity she wants to use for her company. Let's have a look at the principal alternatives.

Types of Company Organization

We'll break this conversation into two wide groups. Initially, we will see company businesses that do not supply the owner or owners any defense against personal liability. After that, we're going to analyze what are known as limited-liability entities, that are business businesses that usually restrict an owner's obligation to his / her investment in the commercial.

Sole proprietorship

If you are truly the only owner, it is possible to ensure that it stays very easy and run your company as a single proprietor. In a single proprietorship, you might be the business enterprise. To phrase it differently, there is no legal difference between the business and you also. You will be completely really liable for any debts, contracts, negligence or wrongful functions carried out by the company. Regarding the plus part, business is very simple to work, is not susceptible to a lot of business regulations and you simply report earnings and losses through the business on your own private tax return. A youngster's yard mowing solution is a good example of a sole proprietorship.

General relationship

A general relationship is a company possessed by one or more person. Partners frequently get into a cooperation contract, which outlines the rights and obligations of partners. The same as a sole proprietorship, general partners tend to be completely accountable for the debts of the cooperation. In fact, partners will often have joint and many liability, which means a partner could be dinged for 100per cent of the relationship debts and certainly will have to go after their lovers for his or her share.

Regarding the good part, partnerships are flexible to manage provided that the lovers agree. Partnership law isn't that complex. The principal legislation for partnerships could be the Uniform Partnership work as enacted in each condition. Partnership earnings and losings tend to be reported in the individual lover amount because partnerships are believed a flow-through entity - earnings and losings flow through entity to its owners in which it's taxed. The classic exemplory case of a broad partnership is a lawyer partnership.

Business

The corporation could be the original limited liability entity. Many openly exchanged companies, particularly Apple, General Motors and General Electrical, are corporations. Corporations tend to be very regulated by state statutes and therefore are rather rigid in how they can be arranged and handled. The investors (proprietors) pick a board of administrators by-election. The board develops business policy and strategy. The officials of the firm operate the day-to-day functions.